Company valuation

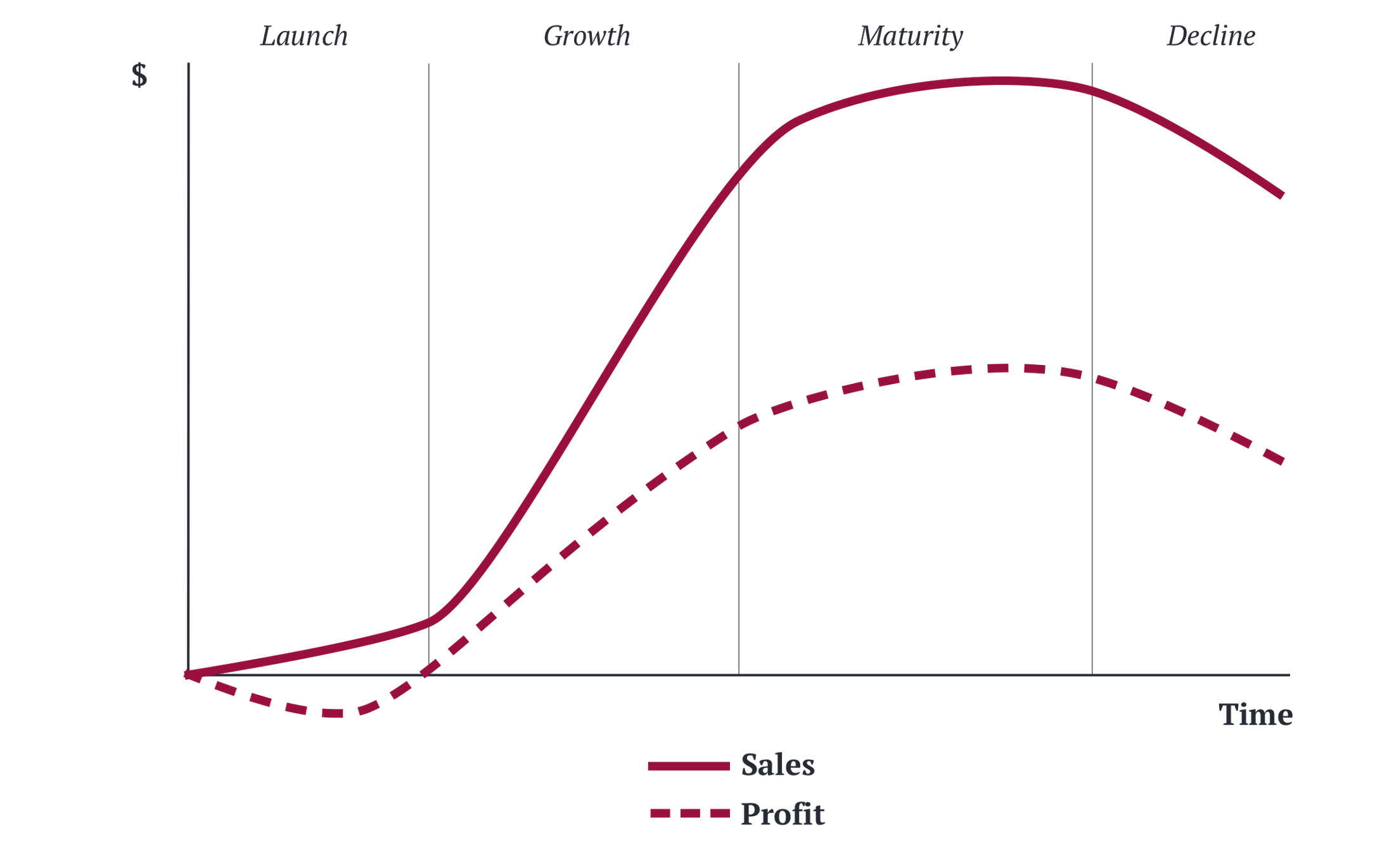

To valuate a company there are many aspects to consider. One important factor is in which state of the company’s life cycle one consider the company to be in. The chart below reflect one way of looking at it, dividing the life cycle into “Launch, Growth, Maturity and Decline”.

Company Life Cycle

For many listed large cap companies they are in the later stages of the life cycle; “Maturity” or even “Decline”. There are mainly three established valuation methods for these matured companies: 1) Discounted Cash Flow calculation (DCF) a method used to estimate the value of an investment based on its future cash flows; 2) looking at the valuation of Comparable listed companies in the same sector (Comps) and 3) Looking at Transactions to see what kind of valuations similar companies have been valued at mergers and acquisitions.

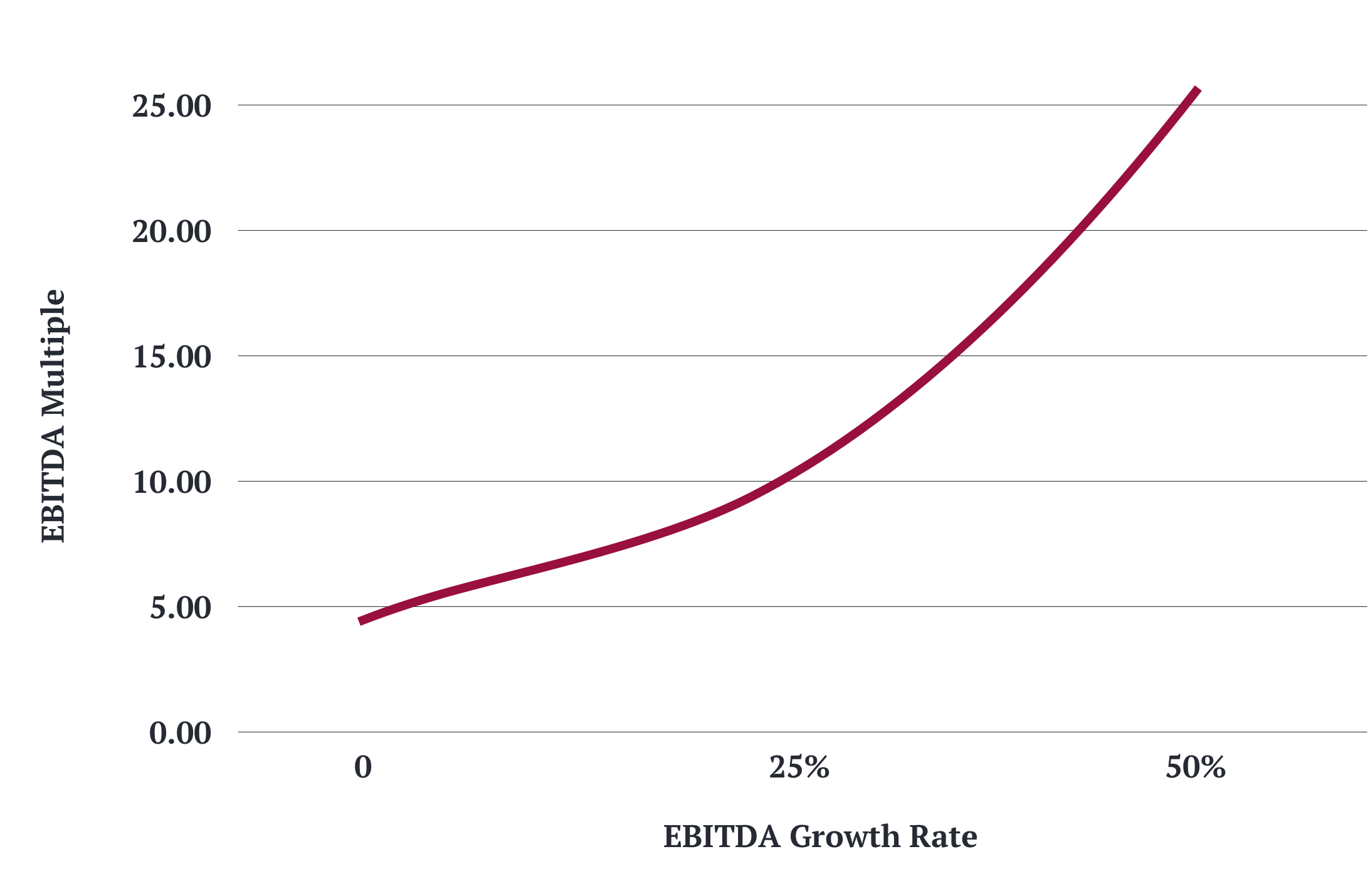

However, at an early stage of a company’s life cycle, especially in the “Launch” and “Growth” stages where the company is yet to reach profitability, the traditional valuation models does not apply. Different valuation approaches are needed! Valuation of startups, early stage and emerging companies are very much about growth prospects! What kind of revenue and profitability growth can we expect? With profitability in connection with company valuation, it is often referred to Earnings Before Interest Tax Depreciation and Amortization (EBITDA). To understand how strongly connected your future EBITDA growth prospect is to your company’s valuation consider the number 1 chart below, showing Company EBITDA growth rate compared to Company EBITDA valuation Multiple (using an 18% Discount factor). If your company can expect an annual 25% growth rate in profitability, your company valuation can be worth a multiplier of 10 times EBITDA. If your company annual earnings growth prospect can instead reach 50%, an earnings valuation multiple of 25 can be expected, an increase of 150%!

Valuation as a multiple of EBITDA with 18% Discount Rate

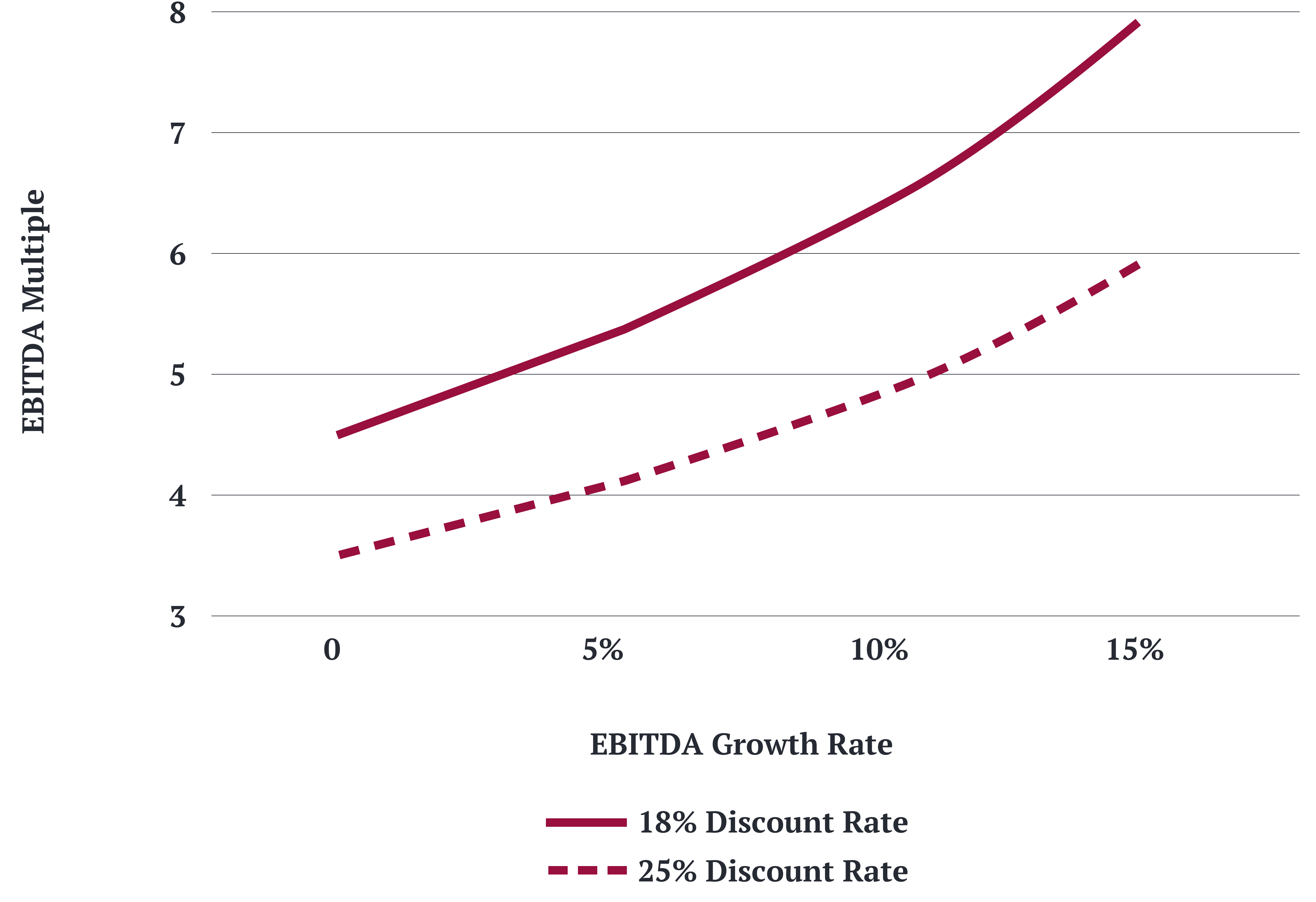

Also, very important in company valuation is the perception of risk in your company operation, your sector business, the market risks in general and the level of interest risks, all compounded to a “Discounted factor” expressed in percent. In chart 2 you can see how two different “Discounted Rates (18% and 25%) affects your company valuation at different EBITDA growth rates. If your business perception of compounded risk is 25% and your EBITDA growth rate is estimated to 15% annually, your company EBITDA valuation multiple can be expected to be around 6 times EBITDA. If the perception of compounded risk in your business can be lowered to 18%, you could expect an earnings multiple of close to 8, an increase of almost 35%!

Valuation using different Discount Rates